Some people’s accomplishments in their chosen profession go beyond the industry in which they operate, making them household names. It’s pretty safe to say that even those uninterested in the world of investing know Warren Buffett.

Buffett epitomizes the term “legendary investor” probably more than any other and given his decades of nearly unparalleled success in stock picking, it’s a well-deserved epithet.

For those looking to emulate a fraction of Buffett’s success, getting a head start, it makes sense to see which stocks currently reside in the Oracle of Omaha’s portfolio. And when some of these stocks also have the backing of one of Wall Street’s major banks, like Goldman Sachs, it sends an even stronger message that now may be the time to stock up.

Against this background, we dug into the TipRanks database for information on three stocks that are currently receiving approval from Buffett and the banking giant. Let’s check the details.

Western Oil (OXY)

For our first Buffett/Goldman-backed name, we will look to the energy sector and the multinational Occidental Petroleum. The Houston, Texas-based company is engaged in the exploration, production and marketing of oil and gas. Active since 1920, Occidental has become one of the largest independent oil and gas producers in the United States. The company also operates globally, with significant operations not only in the United States, but also in the Middle East and Latin America.

Thanks to its know-how and global reach, the company benefited enormously from rising energy prices last year, and like many names in one of the few sectors to thrive, OXY stock. had an exceptional year 2022 – with gains of 117%. But its performance has been more subdued this year.

Affected by lower crude oil, natural gas liquids and domestic natural gas volumes and prices, first-quarter revenue fell 14.9% year-over-year to $7.26 billion dollars, missing Street’s forecast of $110 million. Profits also fell, with adj. EPS down 48% at $1.09, below the consensus estimate of $1.37.

Although free cash flow fell 33% in the first quarter to $1.69 billion, that did not halt the company’s stock buying activities. During the quarter, Oxy repurchased $752 million in stock, meeting its $3 billion buyback program for 2023.

Despite the underperformance, to say that Buffett remains an OXY fan is an understatement. OXY stocks make up a significant portion of his portfolio, and during the first quarter Buffett purchased an additional 17,355,469 shares. In particular, he continued to demonstrate his faith in May by buying around 5.62 million additional shares. As it stands, Buffett’s ownership of approximately 217.3 million OXY shares translates to a staggering $12.73 billion, representing an impressive 24.4% stake in the Company.

Buffett’s unwavering faith in OXY is backed by Goldman Sachs analyst Neil Mehta, who shares a positive view of the company. Mehta, a 5-star analyst, highlights some key reasons why OXY looks promising, noting, “We remain positive on OXY due to its attractive FCF generation potential (13% FCF return vs. 9% for diversified peers) , which can drive a robust stock buyback and allow the company to repurchase its preferred stock and simplify its corporate structure (a goal for the company this year). Our favorable FCF outlook is underpinned by above-cycle average cash flow from chemicals, and we continue to expect favorable results upstream from OXY’s Permian operations.

These comments underpin Mehta’s Buy rating, while his $77 price target leaves room for 12-month returns of 31%. (To see Mehta’s track record, click here)

Elsewhere on Wall Street, the stock is picking up 7 more buys and holds, each, for a consensus Moderate Buy rating. The forecast calls for a year-over-year gain of 22%, given that the average target stands at $71.67. (See OXY Stock Forecast)

Communications Charter (CHTR)

Now let’s move on from energy to a big player in the telecommunications industry. Charter Communications is one of the largest telecommunications and mass media companies in the United States. In fact, by number of subscribers, it is the second largest cable operator in the country. Charter offers a wide range of offerings, including cable television, high-speed Internet, and telephone services to residential and business customers. Operating under the Spectrum brand name, the company serves millions of customers in 41 states.

In addition to its core services, Charter has also ventured into the streaming market with its video-on-demand platform, Spectrum TV, which offers a wide selection of movies and TV shows to subscribers.

Despite missing expectations on the earnings profile in last month’s 1Q23 report, investors apparently preferred to focus on the positives. EPS of $6.65 beat consensus expectations of $7.50, but revenue rose 3.4% year-over-year to $13.65 billion and beat Street’s projection of $40 million. Additionally, adjusted EBITDA increased 2.6% from the same period a year ago to $5.4 billion. During the quarter, the company also reported a record 686,000 wireless net additions.

As for Buffett’s involvement, he owns part of the shares of CHTR. His total holdings of 3,828,941 shares are currently worth more than $1.27 billion.

The telecoms giant also enjoys the support of Goldman Sachs analyst Brett Feldman, who sees satisfactory progress for shareholders.

“We remain confident that CHTR can achieve LSD EBITDA growth in 2023, with growth accelerating in 2H23 as operating costs ease…We continue to expect CHTR to be able to maintain and gradually accelerate its share buybacks over the next 5 years, even during periods of high capital expenditures, based on our outlook for sustained EBITDA growth, which should create additional borrowing capacity that we anticipate CHTR will use to fund buybacks. its market cap,” Feldman said.

As a result, Feldman assesses that CHTR shares a Buy rating with a price target of $450. The implication for investors? Upside potential of 35% from current levels. (To see Feldman’s track record, click here)

The Goldman Sachs view depicts the bulls here; the Street shows a clear split in reviews of CHTR. On 16 recent analyst analyses, there are 7 buys, 8 holds and 1 sell, for a consensus moderate buy rating. Based on the average target of $469.65, investors will pocket returns of 41% per year from now. (See CHTR Stock Forecast)

Marsh & Mclennan Companies (CMM)

Now let’s move on once again to a world-renowned professional services firm that has received endorsements from Buffett and Goldman Sachs. Marsh & McLennan is a leading player in the field, specializing in risk management, insurance brokerage and advisory services. The company operates through its four main subsidiaries: Marsh, Guy Carpenter, Mercer and Oliver Wyman. With expertise spanning these diverse sectors, Marsh & McLennan is well positioned to provide comprehensive solutions to its clients globally.

Marsh provides insurance brokerage and risk management solutions to its clients, helping them deal with complex risks while protecting their assets. Guy Carpenter focuses on reinsurance brokerage and strategic advisory services, helping insurers manage their reinsurance needs. Mercer specializes in human resources consulting, offering a wide range of services related to employee benefits, talent management and retirement planning. Finally, Oliver Wyman provides management consulting services, assisting clients in various industries with strategic planning, risk assessment and operational improvement.

In business for over 150 years, MMC has established itself as a trusted global name, and that was evident in the company’s latest quarter – for 1Q23. Driven by a strong performance in its risk and insurance services, revenue grew 6.3% year-over-year to $5.9 billion, beating the forecast of $40 million. Adj. EPS of $2.53 improved from the $2.30 generated in the same period a year ago, while also beating Street’s expectations by $0.06. During the quarter, the company repurchased 1.8 million shares of its stock for $300 million.

Buffett enters the frame here via the 404,911 MMC shares he currently owns. At the current price, these are worth over $70.58 million.

The global services company also has a fan in Goldman analyst Robert Cox. Going through the Q1 impression, Cox finds plenty of reassuring points to keep him on board.

“We view the MMC 1Q23 results as further evidence that the company is benefiting from strong P&C brokerage conditions, talent investments are delivering results and margins should continue to grow significantly with further expense savings identified,” explained the analyst. “The overall RIS organic growth battered during the quarter, combined with our expectations of a slight deceleration in prices and growth in damage exposure, leads us to raise our RIS organic growth estimate for the year. 23 by 50 basis points to +9.7% (+7.1% excluding income from fiduciary investments).”

Putting these thoughts into notes and numbers, Cox assesses that MMC shares a buy, backed by a price target of $202. If the figure is reached, investors are looking at a 16% upside from current levels. (To see Cox’s track record, click here)

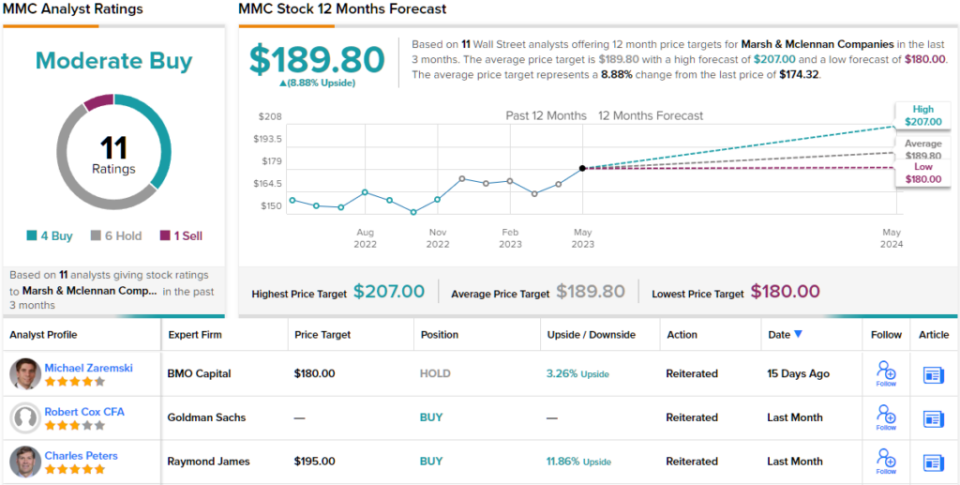

Looking at the consensus breakdown, 3 analysts join Cox in the bullish camp and with 6 additional holds and 1 sell, the stock boasts a Moderate Buy consensus rating. At $189.80, the medium target implies the stock has room for growth of around 9% over the next few months. (See MMC Inventory Forecast)

To find great stock trading ideas at attractive valuations, visit TipRanks’ Best Stocks to Buy, a recently launched tool that brings together all of TipRanks’ stock information.

Disclaimer: The opinions expressed in this article are solely those of the analysts featured. The Content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.