-

The US consumer is doing very well and their resilient spending habits should help stave off a recession.

-

That’s true even amid concerns about dwindling excess savings and the impending resumption of student loan repayments.

-

These five charts help show how resilient the US consumer is despite fears of a recession.

The US consumer is doing very well as they continue to spend money despite high inflation and lingering fears that a recession will soon hit the economy.

Although some commentators have sounded the alarm, the American consumer is not in imminent financial trouble due to dwindling excess savings due to the COVID-19 pandemic in addition to expected student loan repayments. resume later this year.

That’s the big takeaway from Carson Group’s chief market strategist, Ryan Detrick, who highlighted just how strong the consumer really is based on various sets of economic data in the mid-term outlook report. company year 2023.

The consumer is important to follow because approximately 70% of the US economy is driven by consumer spending, which is heavily dependent on the daily spending habits of more than 300 million Americans.

And current data points to stronger trends today than before the pandemic.

These are the five key charts that show just how strong the consumer is and why that strength should continue to protect the US economy from an impending recession.

1. Monthly debt payments are manageable.

“When you think about debt, the key question is whether households are able to repay that debt,” Detrick said.

Enter the household debt-service ratio, which measures the percentage of consumer income used to pay off all types of debt, from mortgages to credit card bills to student loans.

According to JPMorgan’s estimates, the household debt-service ratio at the end of the second quarter was 9.7%. This figure is well below the 13.2% reading seen in the fourth quarter of 2007, and it is also below the pre-pandemic average of 11.2%. This gives the consumer ample leeway to take on more debt if needed, which would lead to increased spending and help revive the economy.

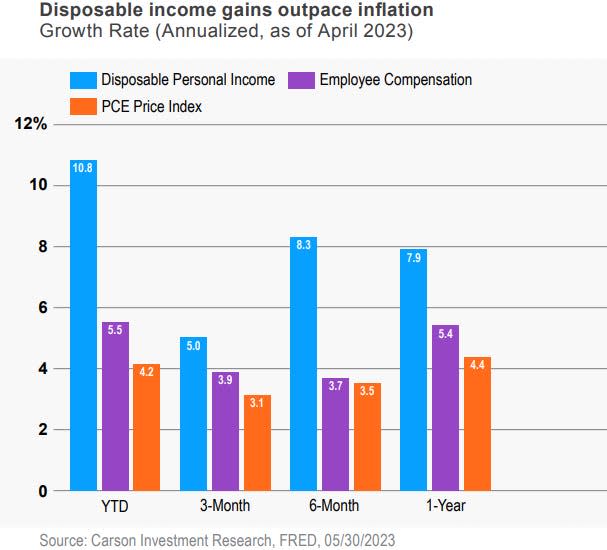

2. Real income growth.

For most of the past two years, wage gains have not kept pace with rapidly rising inflation. But with inflation falling and wage gains stable, that has changed. This means that consumers finally have more money in their pockets, another good sign that should support the economy going forward.

“Disposable income grew at an annualized rate of 10% in the first five months of this year. Meanwhile, inflation is around 4%, which means households are seeing real income gains” , said Detrick.

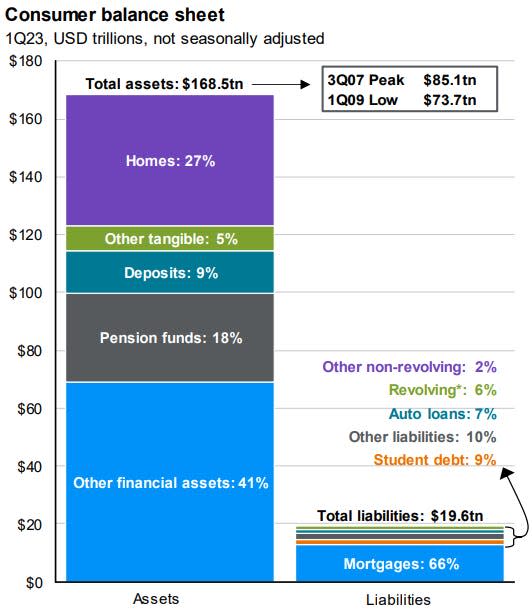

3. A healthy balance sheet.

Consumers have total assets of $168.5 trillion, compared to just $19.6 trillion in debt. This is a healthy balance sheet and does not portend a period of weakness to come.

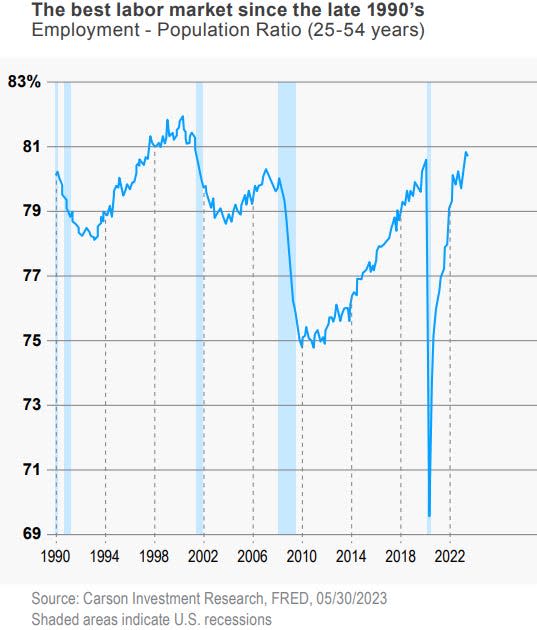

4. A dynamic labor market.

In the end, all that matters is that consumers have a job, because that’s what drives most of their consumption habits. If they have a salary, they spend money. So it’s no surprise how important the strength of the job market is to the consumer, and right now the job market is doing well, with plenty of vacancies for those looking.

“The employment-to-population ratio of prime-age workers (25-54), which takes into account labor force problems and an aging population, is now 80.7%. That’s higher than at any time between 2002 and 2022. That’s truly remarkable and indicates a labor market that’s the strongest we’ve seen since the late 1990s,” Detrick said.

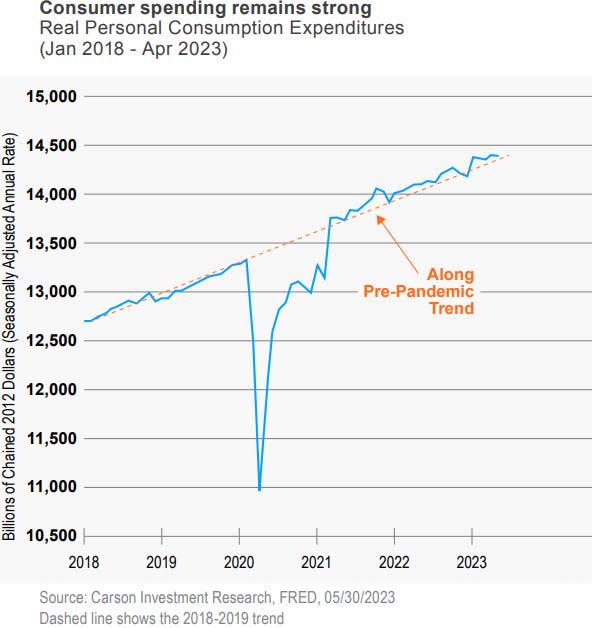

5. Strong spending trends.

“Consumption continues to follow the pre-pandemic trend, even after adjusting for inflation…Spending driven by rising real incomes means consumers don’t feel the need to borrow as much as they did before. the pandemic,” Detrick said.

Read the original article on Business Insider