-

AI-related stocks have soared this year, but retail investors aren’t driving the stock, Vanda Research said.

-

“Our internal positioning in US equities shows that retail investors are staying on the sidelines despite the recent AI craze.”

-

The AI trend is also relatively small compared to the meme stock frenzy surrounding GameStop and AMC.

AI-related stocks like Nvidia have soared this year, but according to a research firm, there’s one part of the financial markets that hasn’t jumped strongly into the buying frenzy: retail investors.

“Our internal positioning in US equities shows that retail investors are staying away despite the recent AI craze,” Vanda Research said in a note last week, adding that institutional investors were the main drivers of demand. of AI actions.

His note came during a big week for Nvidia which highlighted the broad interest in AI sparked by the launch of ChatGPT late last year. Shares rose more than 20% last week after the chipmaker said the AI boom was behind its decision to raise its quarterly revenue projection to $11 billion.

So far this year, Nvidia stock has jumped 167%. Meanwhile, the Global X Robotics & Artificial Intelligence ETF climbed 33%, and the ROBO Global Robotics & Automation Index ETF rose 19%.

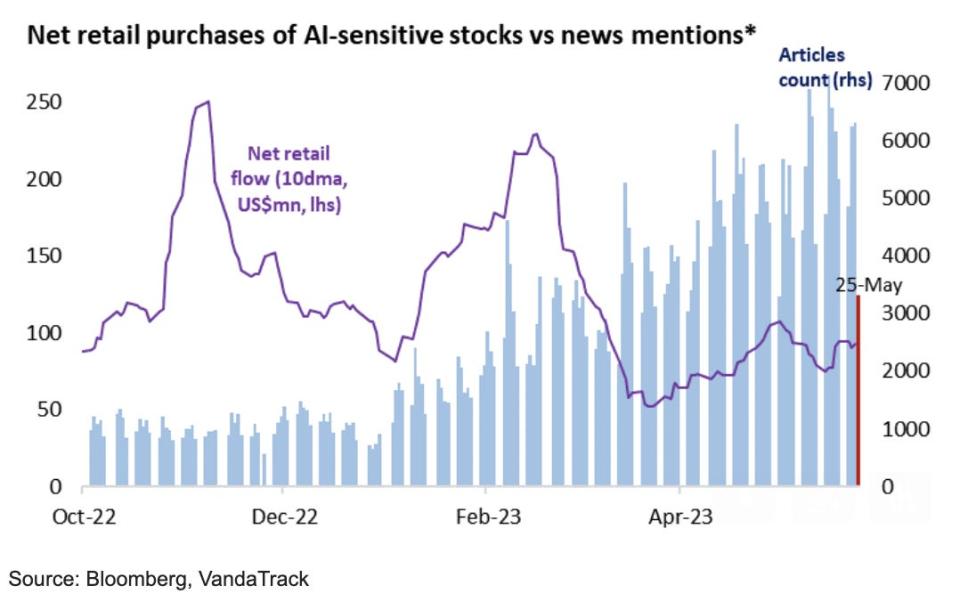

But that didn’t trickle down to the retail side. Vanda, which monitors retail investor activity, has reviewed media mentions of AI since October, as well as net purchases of AI-sensitive stocks by individual investors.

“The craze appears to have triggered only a marginal increase in retail purchases, at least for now,” Marco Iachini, senior vice president of research at Vanda, said in the note. “Indeed, the overlay of news mentions over retail feeds in AI-related stocks and ETFs shows that individual traders are thinking twice about jumping into some of these names.”

Net retail flow into the stock market’s buzzing pocket reached around $250 million on a 10-day moving average late last year as new mentions of AI surged. Since then, that stream has slowed to around $100 million on a 10-DMA through May.

And while the arrival of ChatGPT can be seen as a transformative black swan event, the AI trend is still relatively weak compared to the meme stock trading phenomenon, Vanda added.

Beginning in 2020, retail traders on Reddit’s WallStreetBets forum and other social media sites banded together to take short positions against hedge funds that bet against stocks such as GameStop and AMC.

“Take, for example, the two most popular stocks during the meme bubble, GME and AMC, and compare them to two AI behemoths, NVDA and AMD,” Vanda said.

“The former duo drew more retail streams during both 2021 stock market peaks than the latter, despite having a combined market cap of just $2 billion compared to NVDA and the combined market cap of AMD of $430 billion at the end of December 2020.”

The “only GME-like stock” attracting retail capital is AI enterprise software company C3.ai, but individual investors have refrained from pursuing C3.ai aggressively – another sign of caution, Vanda said.

Overall, retail investors have largely reduced their exposure to the stock market after serving as a mainstay of support for most of the past year, the company said.

Earlier this year, retail investors spent a record $1.51 billion a day in US markets. That spending slowed to about $390 million in daily net purchases of U.S.-listed securities through May.

Vanda thought the strong advance in tech stocks could have bolstered retailer confidence.

“However, it is becoming clear that more concrete signs of a Fed pause, further progress on inflation and the resilience of the macroeconomic environment are likely key missing elements for retailer participation to strengthen” , did he declare.

Read the original article on Business Insider