-

Financial markets have recently raised red flags regarding the Chinese economy.

-

Indeed, lofty expectations of a strong post-Covid rebound have largely failed.

-

But analysts said Wall Street was too myopic and not looking at the long term.

Financial markets have recently raised red flags over China’s economy, but analysts said Wall Street was missing the big picture.

Growth in the world’s second-largest economy accelerated to 4.5% in the first quarter from 2.9% in the fourth quarter, following the easing of COVID-related restrictions late last year.

But more recent data pointed to a slowdown in retail sales growth as well as declines in home sales, industrial production and capital investment.

That disappointed investors who had hoped for a bigger post-COVID rebound and led Wall Street to cut its full-year growth estimates. Concerns about the Chinese economy spilled over into the markets.

Earlier this month, the yuan broke above the psychologically important level of 7 to the dollar for the first time this year. The price of copper, which was once expected to see big gains due to strong demand from Chinese factories, hit a four-month low in mid-May.

Meanwhile, shares of luxury brands that rely on China’s consumer base have begun to slide on sluggish business.

Chinese stock markets were not spared from the slowdown in performance, with the CSI 300 index continuing to fall this week. In late April, dwindling hopes for additional stimulus sent the Shenzhen and Shanghai indexes plummeting $519 billion in a single week.

The waning performance prompted Ruchir Sharma of Rockefeller International to call the rebound narrative a “charade”.

But for one analyst, the growing pessimism around China’s economy could stem more from unrealistic expectations and Wall Street’s tendency to prioritize immediate action over long-term prospects.

“I feel sorry for these people in some ways because every time the Chinese release data, they have to say something about it,” Nicholas Lardy of the Peterson Institute for International Economics told Insider.

The heightened expectations may be due to China’s response to the 2008 financial crisis, when Beijing gave the economy a massive stimulus and achieved double-digit growth, said Duncan Wrigley of Pantheon Macroeconomics.

However, it has also led to a massive hangover that China has struggled to resolve for much of the past decade. So as demand slows, limiting debt growth is also a priority for party leaders, he said.

The country has set a more conservative growth target of 5% in March, which both analysts say is achievable. Although the country is avoiding large-scale stimulus measures to meet the target, it has a number of tools to ensure that growth continues to pick up.

Despite its aim to limit debt, China could increase the availability of cheap loans to sectors in need, as well as lift the lending quota for the three main political banks, while allowing them to invest in local projects, Wrigley said.

If that wasn’t enough, he noted that the People’s Bank of China may ease financial conditions later in the year, such as lowering the reserve requirement ratio for banks.

But youth unemployment remains high, while heightened geopolitical risk could prevent China from accessing foreign technology.

And private investment, a major source of growth in China, has nearly collapsed in the past 15 months, Lardy said.

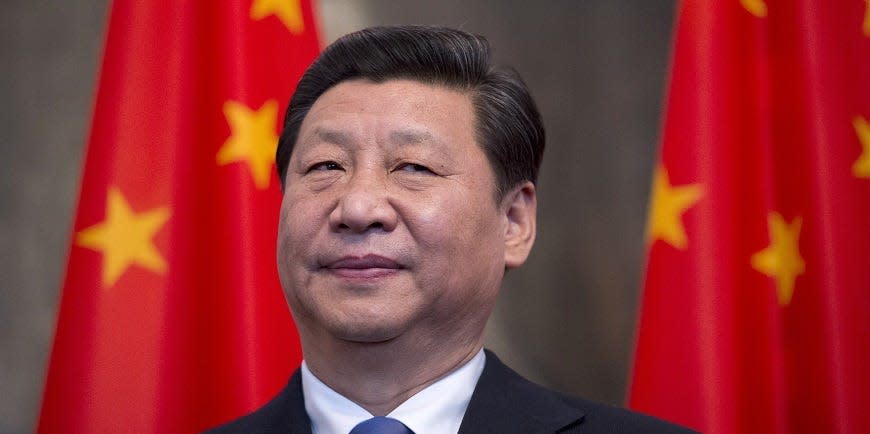

It may be linked to tight regulation of Chinese companies as President Xi Jinping expands the state’s role in the market, discouraging business owners from investing in their businesses, he said.

“That’s the one big negative factor that worries me more than all the other things we’ve talked about. Why is private investment so low?” he said.

Read the original article on Business Insider