-

According to DataTrek, the current bull market in equities is slower and more steady than the high-octane type.

-

The research firm compared the current rally in stocks to previous bull markets, and the results suggest slow gains ahead.

-

“If this analog continues, the [S&P 500] could be mostly flat over the next three months until the anniversary of its October 2022 low.”

The current stock market bull rally should be slow and steady if history is any guide, and that means slow gains ahead, according to a Wednesday note from DataTrek Research.

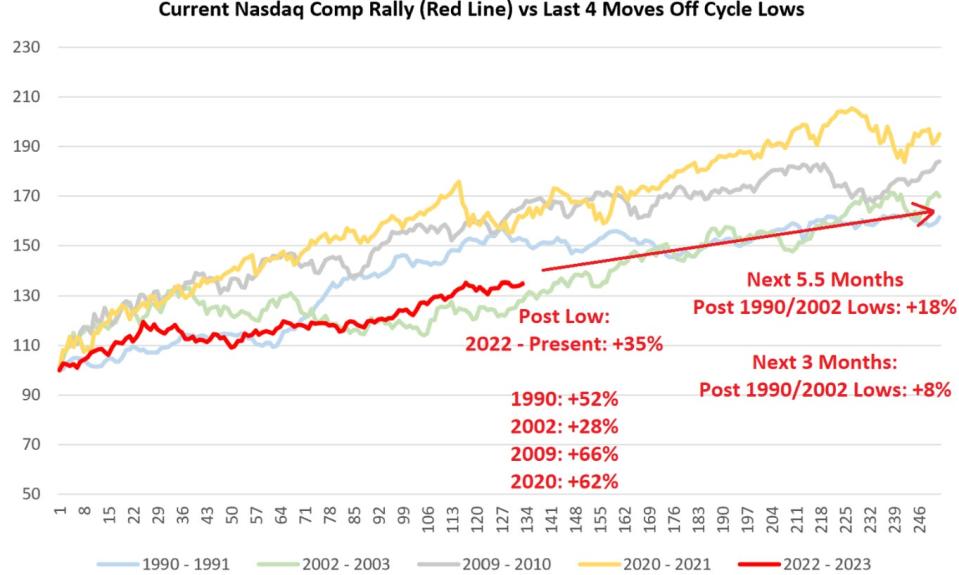

The research firm compared the current stock market rally to four previous bull market cycles that began in 1990, 2002, 2009 and 2020, and found that there are two types of rallies.

One type is a high-octane rally, as seen in the bull markets of 2009 and 2020 when the S&P 500 jumped more than 60% after 185 trading days from its low.

The other type is slow and steady, as seen in the bull markets of 1990 and 2002 when the S&P 500 jumped about 30% after 185 trading days from its low.

With the S&P 500 bottoming out in mid-October 185 trading days ago, it has since risen 24%, putting it in the slow and stable category, according to DataTrek co-founder Jessica Rabe.

“If this analog continues, the index could be virtually flat over the next three months until its October 2022 anniversary low. The S&P is up just 1.3% over the next 66 trading days. starting today taking the average of our 1990 – 1991 and 2002 – 2003 comparisons,” explained Rabe.

It’s a similar story for the Nasdaq Composite, which is up about 35% since its bear market low. Rabe pointed out that the gain is closer to the bull markets of 1990 and 2002 than the bull markets of 2009 and 2020, which saw gains of more than 60% as far from the bottom.

If the Nasdaq follows the same pattern as the bull markets of 1990 and 2002, as it has so far, it could post gains of around 8% over the next three months and gains of 18% in the next three months. course of the next six months.

But there is one catalyst that could shake the current slow-paced bull market into a faster, higher-octane kind of rally, and that’s the Federal Reserve changing its stance on interest rates, according to rating.

“The slower pace of the current S&P and Nasdaq Comp rallies from their 2022 historical lows are unlikely to change until the Fed changes its current hawkish stance on rates,” said Rabe. “While we remain positive on US equities for the second half of the year, the work we have presented here indicates that markets are in ‘slow down’ mode.”

Read the original article on Business Insider