US markets are showing mixed signs, making predictions difficult. The main headwind, inflation, is down, but the labor market is strong, unemployment down and wages up. The Federal Reserve has raised interest rates at the fastest rate since the 1980s, taking them from near zero to over 5% in the past 12 months, risking recession to try to maintain a ceiling on price.

But will the Fed’s efforts be in vain? Interest rate hikes tend to affect markets with a 12 to 18 month lag, and we are now seeing inflation falling – the latest data, for April, showed an annualized rate of increase of 4 .9%, well below last year’s 9.1%. peak. But that 4.9% is still more than double the Fed’s target rate.

This is the background of recent comments by Goldman Sachs chief David Solomon, who believes that inflation still poses a significant challenge to the economy.

“I feel like it’s going to be stickier, it’s peaked, but it’s going to be stickier and more resilient, so that’s why we expect that even if the Fed can take a break and will depend on the data, you maybe have to see higher rate to finally control it a bit more,” Solomon said.

In such a more rigid inflationary environment, investors will naturally turn to defensive stocks – those that can show resistance to a downturn. Using the TipRanks platform, we’ve extracted details on two names Goldman Sachs analysts recommend as defensive stocks. Here are the details.

Flywire Company (FLIGHT)

First on our list is Flywire, an online payment processing service. The company has taken an interesting path in the crowded online payment niche, starting as a specialist in the education sector. Since then, it has expanded its services to include payment processing across a global network, catering to the healthcare, travel and B2B industries in addition to education. Flywire is equipped to handle the security verification and compliance needs of customers, operating in over 140 currencies.

Flywire boasts a truly global reach, with over 3,300 business customers in 240 countries and territories. The company offers service and support in dozens of languages around the clock, making the checkout process seamless from every angle. In addition to big names like Mastercard, Visa, and AMEX, Flywire also partners with PayPal and Venmo.

As a defensive stock, Flywire benefits from the global shift to digital transactions and the paperless office. Businesses of all sizes, from the smallest Mom & Pop stores to industry giants like Mastercard, can realize efficiencies by moving from paper-based transactions to digital processing. As an electronic payment specialist, Flywire positions itself advantageously at the right time and in the right place. Shares of the company are up about 21% this year, far outpacing the S&P 500’s 8% year-to-date gain. With clear indications of continued expansion in the digital payment space, Flywire is strongly positioned to support its growth alongside its customer base.

Overall earnings from the company’s 1Q23 financial release tell the story: Flywire revenue grew 46% year-over-year to $94.4 million – and it exceeded forecast by nearly $11.48 million. Like many tech companies, Flywire is posting a net loss, but its first-quarter EPS loss of 3 cents compares favorably to the year-ago quarter’s loss of 10 cents per share — and that was 4 cents per share. better than expected. Flywire’s adjusted EBITDA figure increased significantly year over year, from $1.9 million to $7 million. Flywire’s first quarter highlights included 170 new customer sign-ups, making 1Q23 the company’s largest sales quarter.

For Goldman Sachs, the key points here include Flywire’s strong defensive base and its ability to generate growth in today’s economy. Analyst Will Nance writes: “Looking forward, we believe FLYW’s strong NRR track record, coupled with its commitment to consistent operating leverage, should position the company well to continue to outperform in the near term. In particular, we believe the company’s defensive business mix in education and healthcare is well positioned to absorb the potential for macroeconomic weakness for the remainder of this year.

“In summary,” the analyst summed up, “with shares trading at 47x our 2024 EBITDA estimates, we believe valuation is attractive in the context of FLYW’s ~30-40% growth rates, of its impressive rate spread expansion and the sustainability of its strong NRRs as its record cohorts of recent years continue to grow.

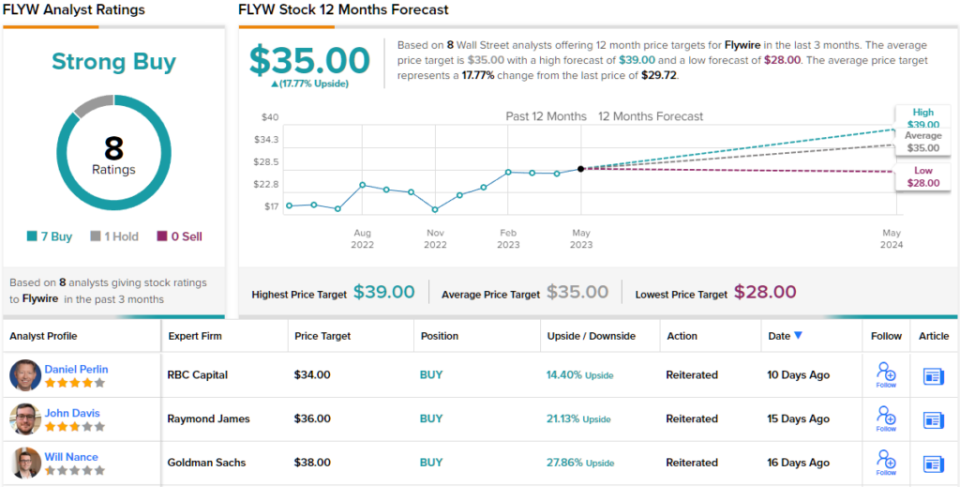

Moving forward, Nance assigns FLYW shares a Buy rating with a price target of $38 that implies around 28% upside potential over the coming year. (To see Nance’s list of winners, click here)

Goldman’s take is hardly an outlier. Of the 8 recent analyst reviews, there is a clear 7 to 1 split in favor of Buy recommendations over Holds, indicating a strong Buy consensus rating. Currently priced at $29.72, the stock holds an average price target of $35, indicating an estimated 12-month upside of around 18%. (See FLYW Stock Forecast)

Walmart, Inc. (WMT)

We will now shift our focus from cutting-edge fintech to one of the most traditional retailers of all: Walmart. Growing from its humble Arkansas roots, Walmart has become the world’s largest retail giant by revenue, generating more than $611 billion in fiscal year 2023 (covering the 12 months ending January 31 of that calendar year). The company owns both the Walmart and Sam’s Club retail chains, operating a wide range of supercenters, discount department stores and grocery stores in the United States and around the world. In total, Walmart has more than 10,500 stores in 24 countries and operates under 46 different names.

Walmart recently released its financial results for the first quarter of its fiscal year 2024 and showed that it is maintaining its growth trajectory. The company reported total quarterly revenue of $152.3 billion, up 7.6% year-over-year and $4.39 billion above estimates. The company’s non-GAAP EPS of $1.47 was 15 cents higher than expected.

Among the results, US component sales increased 7.4% year-on-year; e-commerce, which has seen impressive growth of 27%; and global advertising activity, which saw a 30% year-over-year increase.

Also in the fiscal first quarter, Walmart returned $2.2 billion in capital to its shareholders. Much of that came from the company’s dividend, which was last declared at 57 cents per common share for payment on May 30. While the annualized rate of $2.28 per share yields a modest yield of just 1.54%, investors should note the dividend. Reliability: Walmart has been paying dividends since 2003, hasn’t missed a quarter, and has increased the payout every year.

In addition to its classically defensive dividend payouts, Walmart shares have shown an ability to grow even in the face of strong headwinds.

None of this was lost on Goldman analyst Kate McShane, who said of Walmart: “We believe WMT is a stock that investors still want to own given its short-term defensive qualities as well as the improved long-term profitability profile. ”

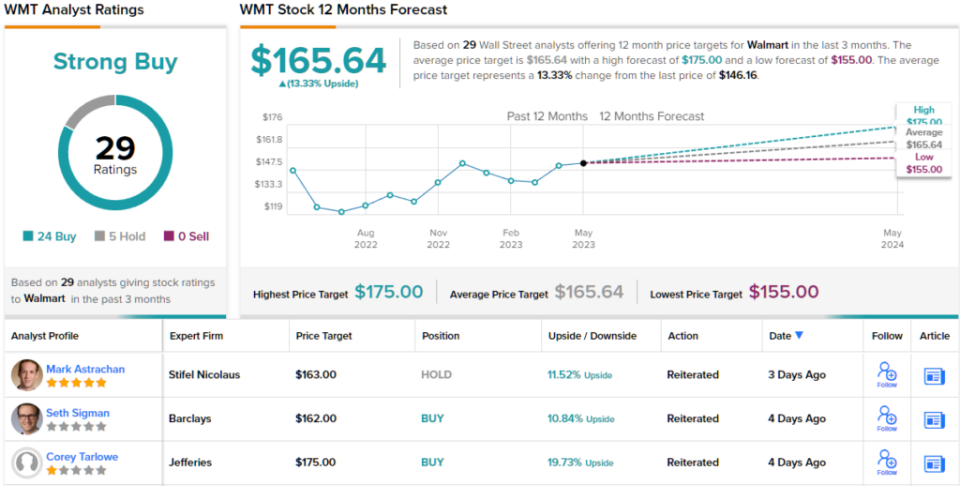

To that end, the 5-star analyst notes that WMT shares a buy, and its price target, set at $176, suggests the stock will rise 20% over the coming year. (To see McShane’s track record, click here)

The biggest names on Wall Street are never short of analyst interest, and Walmart is no exception. The stock has garnered 29 recent analyst reviews, including 24 buys and only 5 takes, for a strong buy consensus rating. Walmart shares are currently trading at $146.16 and have an average price target of $165.64, implying a 13% gain on the one-year horizon. (See WMT Stock Forecast)

To find great stock ideas trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that brings together all of TipRanks’ stock information.

Disclaimer: The views expressed in this article are solely those of the analysts featured. The Content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.