It’s no secret that the stock market has rallied this year, with year-to-date gains of nearly 17% on the S&P 500 and 35% on the NASDAQ. There are also rumors that this rally could turn into a real bull market, putting investors in a good mood and providing a welcome counterpoint to the widely held belief that the United States will experience a recession later this year.

Looking at the market situation from Goldman Sachs, VP Deep Mehta sees two ways to take advantage of the current rally: growth and margin expansion. Regarding the growth trajectory, Mehta writes, “We believe the recent growth outperformance is creating a scarcity of strong growth that is still reasonably priced and should cause investors to prefer stocks that are on the verge of achieve their multiples”. Regarding margins, Mehta adds, “We believe margins will remain a focus through 2023 and into 2024. While operating margins are expected to increase for our broader coverage through 2024E, the dynamic is likely to vary from company to company. As such, we expect companies capable of delivering revenue growth alongside margin expansion to be better positioned.

Looking for growth opportunities, Goldman analysts have picked stocks they believe are poised to pounce. In fact, analysts see one particular pair of stocks generating gains of up to 85% over the coming year. To gauge consensus among other analysts, we used the TipRanks database. Here are the details.

BioMarin Pharmaceutical (BMRN)

We will start with the biopharmaceutical sector, where BioMarin is working on new treatments for rare diseases of genetic origin. The company is currently focused on bringing a range of approved drugs to market while maintaining an active research pipeline. BioMarin’s line of approved products generates the funds necessary for ongoing research. In fact, the company reported over $2 billion in total revenue last year.

BioMarin, which is one of the growth picks on Goldman’s list, has a commercial footprint in 78 countries. This footprint includes Vimizin, a treatment for the genetic enzyme disorder Morquio A, which causes severe damage to bone, cartilage and ligament tissue; Naglazyme, a treatment for the progressive wasting syndrome of Maroteaux-Lamy syndrome; and Roctavian, a treatment for adults with severe haemophilia A, by controlling bleeding.

A look at BioMarin’s 1Q23 results reveals the solid foundation the company has built, thanks to its extensive product line. The company saw a 5% year-over-year increase in revenue from its enzyme products, reaching $448.1 million. This overall result includes a 3% year-over-year growth in Vimizin’s revenue, totaling $189.2 million. Notably, revenue from Voxzogo, a drug used to treat children under 5 with achondroplasia, a genetic condition causing extremely short stature, rose 346% year-over-year to $87.8 million.

Overall, BioMarin generated $596.4 million in total revenue for the first quarter, a figure that translated into a 15% year-over-year gain, and was $26 million. dollars ahead of forecast. The company’s net income was profitable – non-GAAP EPS of 60 cents, or 20 cents per share higher than expected.

Looking ahead, BioMarin expects Voxzogo to be its biggest revenue generator this year, bringing in between $380 million and $430 million, with the recently approved Roctavian bringing in between $50 million and $150 million.

These numbers indicate strong growth potential for BioMarin, and this growth potential caught the attention of Salveen Richter, one of Goldman Sachs’ 5-star analysts.

“We view BMRN as a profitable growth play at current levels – noting that ex-Roctavian trading activity is around $95/share by our DCF assuming a peak of $1.2 billion in sales for Voxzogo, which sounds conservative… Recent US approval for Roctavian in severe hemophilia A sets up for a solid launch in 2H. Additionally, we see potential for expansion of Voxzogo into achondroplasia in younger patients and other genetic causes of short stature,” said Richter.

Quantifying her position, Richter is pricing BMRN shares as a buy, and her price target, which she has set at $159 per share, implies 85% one-year upside potential. (To see Richter’s track record, click here)

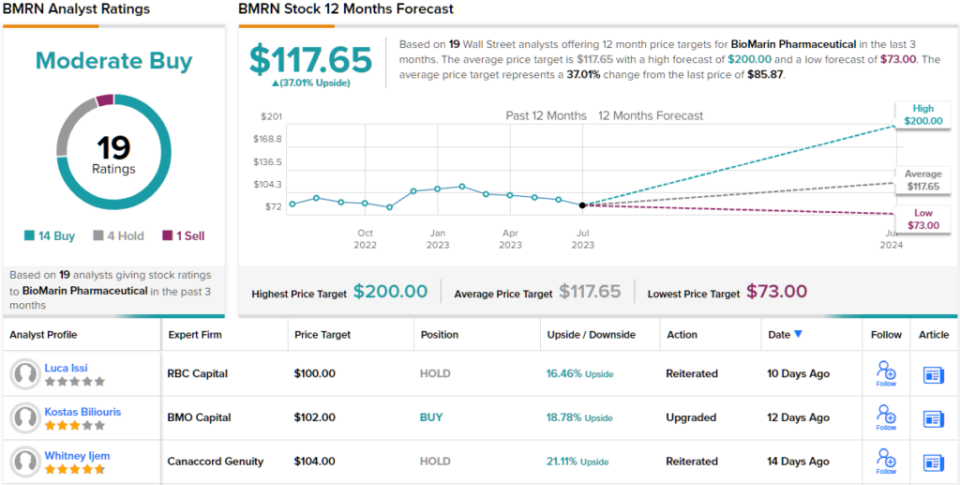

Overall, BioMarin earns a moderate buy consensus rating from Wall Street. This rating is based on 19 recent analyst analyses, including 14 buys, 4 holds and 1 sell. The shares have an average price target of $117.65, which suggests upside potential of 37% over the next 12 months. (See BMRN Stock Forecast)

Vertex, Inc. (VERX)

It happens every spring, no matter how much everyone prefers to avoid it – tax season is the time for everyone to properly declare their income, tax requirements, tax deductions, payments or debts to the IRS. And with tax season comes the need to gather regular reports and keep company books up to date. Vertex, based in Pennsylvania, offers a range of products tailored to the tax compliance needs of companies, particularly through the automation of indirect tax processes.

The company takes a broad approach to its target audience, creating tax software that can be tailored to businesses of all sizes. Vertex’s tax compliance software lines include Vertex TaxCalc, enabling accurate tax calculations in all jurisdictions; Vertex TaxCompliance, to streamline filing, online sales and cross-border trade; and Vertex TaxInsight, designed to “proactively manage risk.” Taken together, these products offer solutions to most common tax issues faced by businesses across the economy.

The ever-expanding scope of government tax regulations keeps Vertex relevant, and the company has seen a clear pattern of steady revenue growth over the past several years. In the most recently reported quarter, 1Q23, Vertex reported revenue of $132.8 million, reflecting a 15.5% year-over-year gain. The company’s revenue slightly exceeded forecasts by around $724,000. Ultimately, Vertex reported EPS of 8 cents based on non-GAAP measures, in line with analysts’ expectations.

Vertex is among Goldman’s margin picks for the year ahead, so a quick look at the company’s non-GAAP gross margin is in order. This metric came in at 71.8% in the first quarter of this year, a strong result that was up 2.3% year-on-year.

Goldman’s Adam Hotchkiss notes that margin performance is a key driver of the stock’s potential, noting, “We continue to expect gross margins to be a key driver here as the company capitalizes on its accelerated investments. in infrastructure over the past two years, while we also believe that the successful ERP modernization that will be completed in 2Q23 will help drive further operating expense leverage in the second half of this year. year and beyond.

“We view this as one of the few software stories where there are significant near-term structural tailwinds to operating expenses and gross margins that we believe are missing the consensus. Although VERX stocks have outperformed the market since the start of the year, we believe that the risk-reward ratio continues to trend upward,” Hotchkiss summarized.

Hotchkiss’ comments along with his Buy rating on the stock and his $25 price target indicate his belief in a 33% upside for the coming year. (To see Hotchkiss’ track record, click here)

Overall, VERX stocks are rated moderate buy by Wall Street analyst consensus. The stock has 10 recent analyst reviews, breaking down into 6 buys, 3 holds and a single sell. The shares are trading at $18.78 and their average price target of $23.56 suggests they will gain about 25% on the one-year horizon. (See VERX Stock Forecast)

To find great stock ideas trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that brings together all of TipRanks’ stock information.

Disclaimer: The views expressed in this article are solely those of the analysts featured. The Content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.