Year-to-date, the S&P 500 has returned an impressive 14%. However, these gains are a bit disappointing as most of the upside was only driven by a few select stocks, namely tech megacaps (AAPL, MSFT, NVDA, META, AMZN). Excluding these five stocks, the index rose only 5%.

While one could argue that the market should see a downturn after such a rally, Goldman Sachs’ chief US equity strategist, David Kostin, suggests otherwise, citing past evidence. “Previous bouts of sharp reduction in magnitude were followed by ‘catch-up’ from a broader reassessment,” Kostin explained.

As such, Kostin not only raised Goldman’s year-end price target for the S&P 500 from 4,000 to 4,500 (a 12.5% increase), but there’s also the stock outlook. who have yet to reap the benefits of the gap-closing rally as the year progresses. .

Against this backdrop, Goldman Sachs analysts have researched these stocks and focused on two that have a lot of potential, according to their calculations – in the range of 90% or more. Scrolling through the tickers in the TipRanks database, it’s clear that Goldman isn’t alone in thinking these stocks have a lot to offer investors; both are also ranked as Strong Buys by analyst consensus.

Rent the track (HIRE)

Our first Goldman-backed action is a disruptor in the fashion industry. Rent the Runway lives up to its name by accurately describing its business, which is to provide customers with the opportunity to rent high-end fashion items. This concept of temporary ownership allows customers to browse a diverse range of styles, sizes and brands on the Rent the Runway website or mobile app. They can then choose items to rent for specific occasions or periods. The platform offers options for one-time rentals and subscription plans. In line with 2023 trends, the company is using AI algorithms and machine learning techniques to improve various aspects of its business, including inventory management and personalization.

It’s a formula that helped the company deliver a strong set of results in its most recent reading – for the first fiscal quarter of 2023 (April quarter). Revenue rose 10.6% year-over-year to $74.2 million, beating Street expectations of $0.99 million. Similarly, the EPS of -0.46 is better than the -0.49 the tipsters were looking for. That said, concerns about the outlook weighed on performance. The company sees FQ2 revenue at between $77 million and $79 million. The consensus was looking for 81 million.

Equities have fallen as a result and have generally lagged the market this year – down 24% so far. For Goldman Sachs analyst Eric Sheridan, however, the current valuation represents an opportunity for investors.

“In our view, RENT’s shares (at current levels) do not take into account the multi-year scenario of 25% revenue growth and scaling margins that are managed described last quarter,” said the 5-star analyst “Long term, we continue to see RENT as the leader in the subscription-based effort to drive adoption of the sharing economy theme in the apparel industry.” In particular, we would point to RENT mgmt’s comments on AI as a positive potential for their platform and a broader disruptive force for the industry that deserves greater attention over the coming quarters.

These comments underpin Sheridan’s Buy rating on RENT, while his $6 price target suggests the stock will rise 150% over the coming year. (To see Sheridan’s track record, Click here)

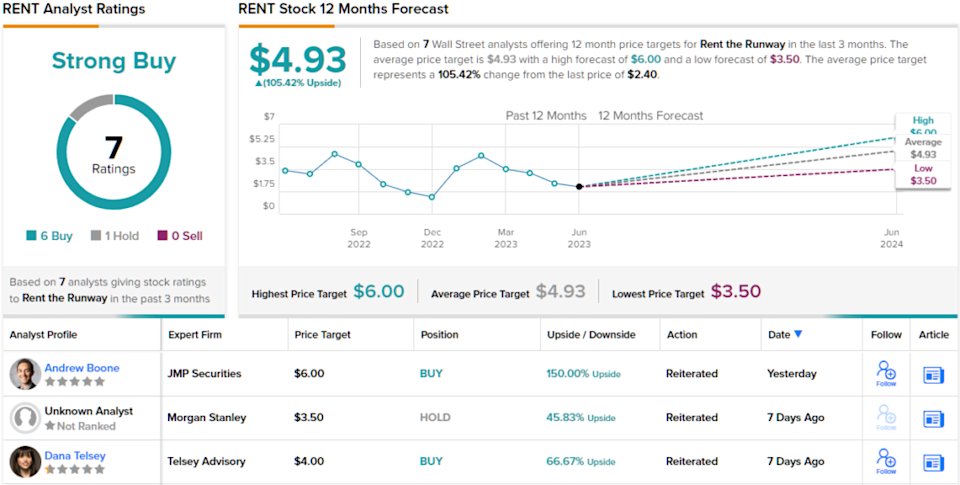

Sheridan’s optimistic thesis is supported in the streets. The consensus strong buy rating for the stock is based on 6 buys to 1 hold. Additionally, the average target of $4.93 leaves room for one-year gains of 105%. (See RENT stock forecast)

Arrowhead Pharmaceuticals (ARWR)

For our next Goldman-backed name, we’re going to shift gears and head into the biotech space. Arrowhead Pharmaceuticals is at the forefront of RNA interference (RNAi) therapy, developing innovative drugs that target and silence specific pathogenic genes. The company’s cutting-edge technology, known as the Targeted RNAi Molecule (TRiM) platform, enables the precise delivery of RNAi drugs to specific tissues and organs, opening new possibilities for the treatment of various diseases.

The company has a long and diverse clinical pipeline and eye-catching industry collaborations including Takeda, Amgen and Horizon Therapeutics. Looking ahead, Arrowhead expects to have 18 drug candidates in clinical studies by the end of 2023, treating a wide range of cell types, such as liver, solid tumors, lungs, CNS and skeletal muscles. It also already has candidates in phase 3 studies.

Later in development, but with promising advances, the company is also developing ARO-RAGE, currently in a phase 1/2 study for the treatment of asthmatic patients. This drug has shown positive results. At Arrowhead’s recent R&D day, the company presented data that showed a single inhaled dose of 184mg destroyed the RAGE protein – which is correlated with lung diseases such as asthma – by an average of 90% and up to a maximum of 95%.

The drug’s potential caught the attention of Goldman Sachs analyst Madhu Kumar, who lays down the therapy’s bullish thesis.

“There is significant market potential for ARO-RAGE in the broader asthma therapeutic landscape,” said the 5-Star Analyst. “Specifically, we estimate the market for eosinophilic asthma biologics to reach over $4 billion in 2023 and grow to approximately $7 billion over the next five years. This estimate takes into account sales estimates for Tezspire from AMGN and JNJ, Nucala from GSK, Fasenra from AZN and Dupixent from REGN and SNY.

“Although many of these biologics share the same once-every-four-week dosing regimen as ARO-RAGE (although ARO-RAGE could potentially be dosed less frequently), we see potential for differentiation in this regarding efficacy, including exacerbation rate, forced expiration volume in 1 second (FEV1) and fractionated exhaled nitric oxide (FeNO),” Kumar continued.

How does all this translate for investors? Kumar rates the stock as Buy, supported by a price target of $68. If this figure is reached, investors will pocket returns of 92% in one year. (To see Kumar’s track record, Click here)

Elsewhere on the street, ARWR receives 8 buys and 3 more takes, all culminating in a strong buy consensus rating. Based on the average target of $61.45, the shares will rise by around 74% over the 12 month period. (See ARWR Stock Forecast)

To find great stock trading ideas at attractive valuations, visit TipRanks’ Best Stocks to Buy, a recently launched tool that brings together all of TipRanks’ stock information.

Disclaimer: The opinions expressed in this article are solely those of the analysts featured. The Content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.