Few things spark the imagination of wealth better than a gold mine. After all, although money doesn’t grow on trees, we can actually dig it up. Our wealth-related metaphors often revolve around gold, with phrases like “things as good as gold” and “an asset that looks like a gold mine.” Indeed, gold is the ultimate symbol of wealth and prosperity.

Although owning a gold mine may be a distant dream for many, investing in gold mine stock presents a very feasible opportunity. Mining companies are an important segment of the stock market. They will focus on different resources, some foraging for gold, some for silver, others for mining base metals like copper or zinc. All can generate profits when managed effectively, and investors can find sound choices across the mining sector.

But we are talking about gold. Barclays, the London-based banking giant, released a report focused on the North American mining sector, and in particular American gold miners. The firm’s 5-star analyst Matthew Murphy notes headwinds – a slow recovery in China, a downtrend in the euro zone – but adds that he expects U.S. mining companies to do well, buoyed by continued demand for gold.

“We expect most of our businesses to perform marginally better in the second quarter, even amid some deterioration in commodity prices. We remain more constructive on gold than copper as the economic deceleration continues,” Murphy wrote.

Ultimately, Murphy has several specific recommendations when it comes to gold mining companies. We dug into the TipRanks database to uncover details on two of them, both sporting Buy ratings and offering double-digit upside potential.

Newmont Mines (NMS)

We will start with Newmont Mining, one of the largest gold producers in the world. The company has a market capitalization of $34 billion, and although it also produces silver, copper, lead and zinc, its primary business is gold mining. Newmont, which is based in the state of Colorado, is active in North and South America, and also has operations in Australia and the West African nation of Ghana.

While Newmont was the world’s largest gold producing company in 2022, in the last reported quarter, 2Q23, it saw a 17% drop in gold production from a year earlier. This decrease is mainly caused by the suspension of operations at the Penasquito mine in Mexico due to a workers’ strike. Additionally, the Cerro Negro mine in Argentina and the Akyem mine in Ghana also underperformed, contributing to weaker than expected results.

As such, the company missed expectations for both revenue and earnings in the second quarter. Revenue fell 12.4% year-over-year to $2.68 billion, in turn missing the consensus estimate of $220 million. Adj. EPS of $0.33 is slightly below the forecast of $0.47.

Shares fell 6% in the following session, marking the biggest daily decline in stocks since July 2022.

Nevertheless, Newmont is actively working to expand its business and to that end, in May this year the company reached an agreement to acquire Australia’s Newcrest Mining Limited for approximately $19.5 billion. Newmont will acquire 100% of the shares of Newcrest and this decision will give Newmont control of Newcrest’s portfolio of assets. The transaction is expected to close in the fourth quarter and the combined entity will have the world’s largest concentration of Tier 1 mining operations.

Looking ahead, Murphy of Barclays is impressed with the potential inherent in Newmont and writes of the company’s outlook: “We expect NEM’s average production to grow by ~40% for gold at 8.9 Mozpa and ~300% for copper at ~390 Mlbpa over the next five years, and expect nearly two-thirds of gold production (5 Moz) to come from 10 Tier 1 assets ( before considering any rationalization of the portfolio). We expect cash costs and AISC to increase slightly post-trade (~2-3%) to ~$740/oz and ~$1,015/oz, respectively, but improve over time as efforts to leverage NEM’s full potential are implemented.

Murphy then rates the stock as overweight (a buy), and he sets a price target of $61 which implies a one-year gain of 41%. (To see Murphy’s track record, click here.)

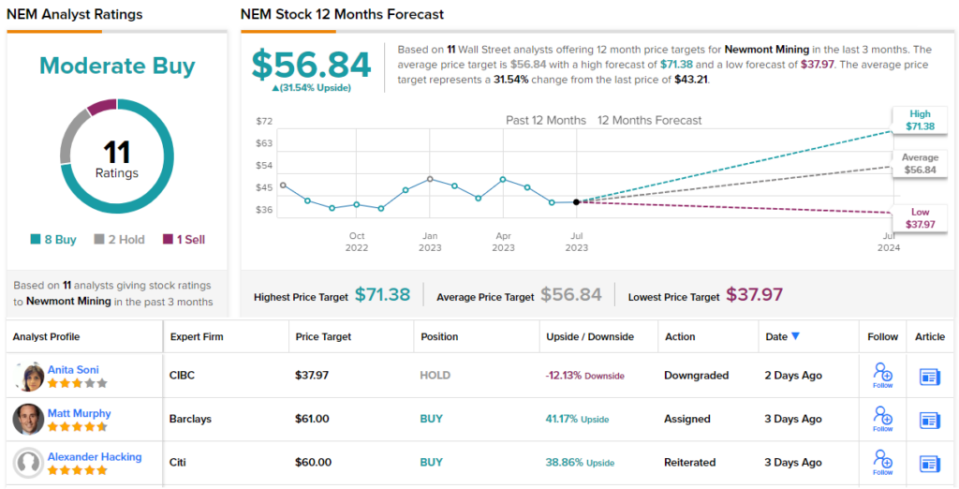

Wall Street is generally bullish on Newmont, although some analysts have reservations. The stock has 11 recent analyst analyses, broken down into 8 buys, 2 holds and 1 sell, for a moderate buy consensus rating. The shares are selling for $43.21 and the average price target of $56.84 suggests 31% upside potential over 12 months. (See NEM stocks forecast)

Agnico Eagle Mines (AEM)

For Barclays’ second mining pick we’re considering, we’ll look to Toronto-based Agnico Eagle Mines. The company has been in business since 1957 and controls a series of mining projects in Canada, Mexico, Finland and Australia, as well as high quality development projects in the United States and Colombia. Agnico produced more than 3.1 million ounces of gold in 2022, at a production cost of $843 per ounce.

This production cost is an important metric for investors to consider, especially when compared to the price of gold, which was near $1,800 an ounce at the end of last year. Gold is currently priced around $1,961 an ounce in the commodity markets.

Agnico will release its Q2 results on Wednesday July 26, but we can look to Q1 results to get an idea of its financials. Production numbers remained strong during the quarter and the company generated 812,813 ounces of gold, with total cash costs per ounce of $832 and an all-in sustaining cost (AISC) of $1,125 per ounce. On this basis, the company achieved total revenue of $1.51 billion, beating the forecast of $21.6 million. EPS reached $0.58, also beating expectations – by $0.09.

The company’s operating cash flow in the quarter was $1.30 per share, and Agnico declared a common stock dividend of 40 cents for the first quarter. Agnico’s current dividend yields 3.2% and the company has maintained regular payouts since 1983.

Looking forward, Agnico expects full-year gold production to be between 3.24 million and 3.44 million ounces, with an AISC between $1,140 and $1,190.

In his coverage of this title, analyst Matt Murphy sees several paths to continued profitability, primarily from Canadian mining operations. Murphy says of Agnico: “As we model the current plan for Canadian Malartic and Odyssey as a base case, we have been playing with scenarios of adding lower grade underground reserves near and further (regionally) from higher grade underground reserves. Our preliminary estimate is that these scenarios could add approximately $1-3/sh to our net asset value (3-9%), with lower grade open pits actually offering more potential under our current assumptions. We could also see a scenario with an extension of mine life at the East Gouldie depth; however, with a lifespan already extending to 2042 and exploration costs, this might add less value at present.

Quantifying his position, Murphy rates the stock as overweight (buy), and his price target of $61 suggests the stock will gain 17% in the coming months.

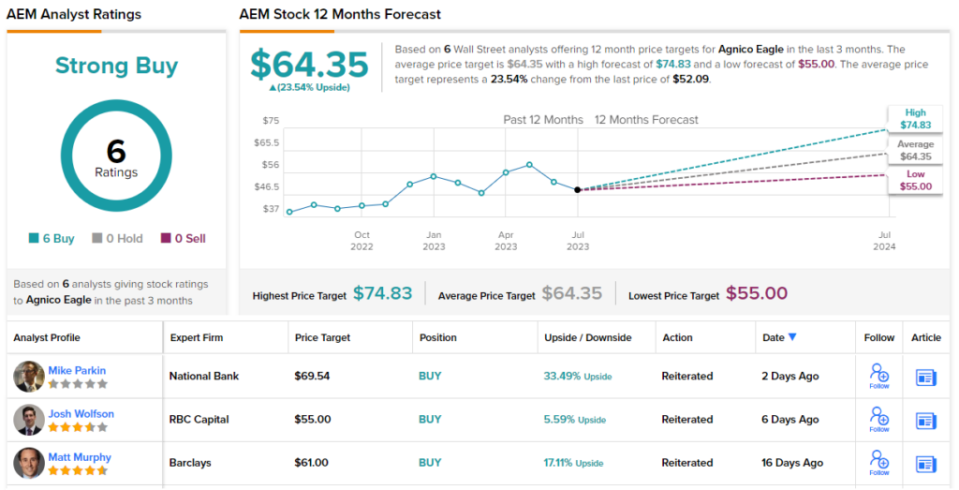

This stock has a strong analyst consensus buy rating, and it’s unanimous, based on 6 positive reviews over the past few weeks. The shares have an average price target of $64.63 and a trading price of $52.09, implying a 23% upside on the one-year horizon. (See AEM Inventory Forecast)

To find great stock ideas recommended by top performing analysts, check out TipRanks’ top analyst stocks.

Disclaimer: Opinions expressed in this article are solely those of the analysts featured. The Content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.