Tesla shares fell more than 9% on Thursday after the company reported mixed second-quarter results. Now some Wall Street analysts say this is just the start of a nightmare for Elon Musk and company.

David Trainer, CEO of investment research firm New Constructs, believes Tesla is worth just $26 a share after its latest earnings showed deteriorating margins and falling demand. That’s about a tenth of the electric vehicle giant’s closing price on Thursday.

“Tesla’s (TSLA) second-quarter earnings confirm our view that the stock is one of the most overvalued stocks in the market,” the veteran analyst wrote in a Thursday note.

Although Tesla managed to beat Wall Street consensus estimates for the second quarter, reporting revenue of $24.9 billion versus $24.51 billion forecast (and adjusted earnings per share of $0.91 versus $0.81 estimated), margins were under pressure.

Tesla’s gross profit margin fell from its peak of 24% in the fourth quarter of 2022 to just 18.2% in the last quarter, slightly below the Wall Street consensus estimate of 18.8%. Musk also signaled third-quarter electric vehicle production would be down slightly, hinted that more price cuts could be on the way, and pointed to unpredictable economics in the company’s earnings call.

Tesla has slashed prices on some of its most popular electric vehicle models over the past year in a bid to battle growing competition and economic headwinds, but the move has some analysts worried about the company’s ability to maintain profitability.

Despite warnings from bears on Wall Street, Tesla stock has jumped more than 140% year-to-date, recovering from a brutal 2022 where tech and growth stocks were hammered by rising interest rates.

After more than a year of economists’ recession forecasts failing to materialize, many investors are anticipating a soft landing for the U.S. economy and prices in a new bull market for tech stocks like Tesla, but David Trainer warned that could be a mistake.

“Tesla shares have risen this year amid a sudden change in overall market sentiment, with many investors now pricing in a soft landing scenario after a brutal past year of Federal Reserve rate hikes,” he said. “But the shift in market sentiment doesn’t change the fact that Tesla’s stock fundamentals are completely out of touch with reality.”

5 reasons to be bearish

Trainer, whose company is known for its focus on analyzing business fundamentals such as cash flow and profit margins, outlined five key reasons Thursday why he is bearish on Tesla shares.

First, he warned that demand for Tesla electric vehicles has become a problem amid growing competition and steady inflation. Tesla has now produced more vehicles than it has sold for five straight quarters, and there are hundreds of promising electric vehicle models expected to hit the market over the next few years.

The only solution to this demand problem is lower prices, Trainer explained, which brings us to his second key concern: margins. As mentioned earlier, Tesla’s gross margins have dropped significantly in recent quarters due to consistent price cuts and rising costs. And “if demand for electric vehicles slows, Tesla could end up with higher than desired inventory levels, which could lead to further price cuts and further pressure on already shrinking margins,” Trainer warned.

Third, Trainer said Tesla was in the midst of “massive cash burn,” noting that the company had negative free cash flow — a measure of the amount of cash a company has left after paying operating expenses and capital expenditures — in all but one year of its existence as a public company (2019).

“Despite Tesla’s revenue growth, it continues to burn huge amounts of cash. Over the past five years, Tesla has burned a total of $4.2 billion in free cash flow (FCF), including $3.6 billion in the last twelve months (TTM) alone,” he wrote.

Fourth, Trainer argued that Tesla’s bulls rely on high estimates for the company’s fully self-driving business and electric vehicle charging network to value the company, but those business segments “are not material” at this time because about 86% of Tesla’s revenue comes from car sales.

“Bulls have long argued that Tesla is not just an automaker, but rather a technology company with multiple verticals such as insurance, solar, housing and, yes, robots. We have long refuted these bull dreams,” he wrote. “Regardless of promises to expand multiple lines of business, Tesla’s business remains focused on its automotive segment.”

Finally, Trainer believes that with price cuts straining margins and increasing competition from traditional automakers, Tesla’s current valuation just doesn’t make sense. “Although Tesla is profitable, its earnings are nowhere near the levels needed to justify its current valuation,” he explained.

Tesla currently trades at around 80 times forward earnings, compared to just over 25 times forward earnings for S&P 500 technology companies.

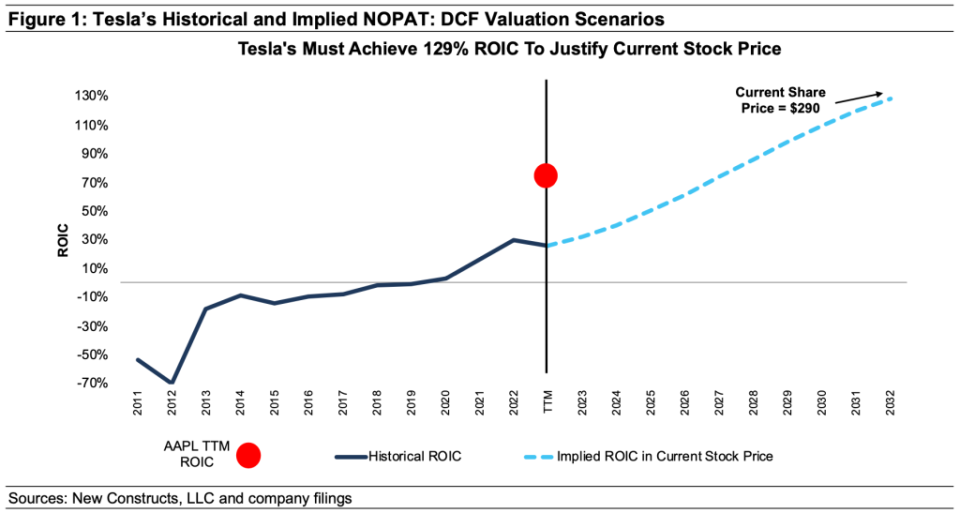

To determine a more accurate valuation of Tesla, Trainer and his team used an inverse discounted cash flow (DCF) model, a valuation method that estimates the level of future cash flow or earnings that would be needed to justify a company’s current stock price.

Using this model, they found that Tesla would need to achieve an almost unprecedented return on invested capital (ROIC) of 129% and become more than twice as profitable as Apple by 2032 in order to justify its current stock price.

For reference, Tesla’s year-over-year return on investment is just 24%, according to Morningstar data, and although the company made a record $12.6 billion profit last year, that was still eclipsed by Apple’s $99.8 billion profit.

“We aim to provide unquestionably best-case scenarios to gauge expectations for market share and future earnings reflected in Tesla’s market valuation,” Trainer wrote. “Even doing this, we find that Tesla is significantly overvalued.”

The case of the bull

Of course, for every bear there’s a bull – and Tesla has its fair share of bulls. Take Dan Ives, Wedbush’s top technology analyst, for example. Ives saw Tesla’s second-quarter earnings in a very different light from Trainer and the bears.

He argued in a Thursday memo that Tesla’s gross margins, which Trainer says will continue to decline, are in “stabilizing mode,” that Musk’s price cuts have helped drive demand for Tesla’s electric vehicles, and that fully autonomous AI technology (FSD) and the electric vehicle charging network will help boost profits for years to come.

“This is the ‘golden vision’ as Tesla now monetizes its supercharger network with batteries and AI/FSD which then adds to the sum of parts story for Tesla,” he wrote in a Thursday note, reiterating his buy-equivalent “outperform” rating and raising his 12-month price target from $300 to $350.

Ives’ comments echo those of Musk, who argued on Thursday that recent price declines are causing “minor” and “short-term” deviations in gross margin, but that ultimately FSD will be the real moneymaker. “Autonomy will make all these numbers look ridiculous,” the billionaire said.

And although Trainer warned that Tesla would need to make nearly double Apple’s current earnings to justify its current valuation by 2032, Ives doesn’t consider that that odd.

“In a nutshell, we see Tesla where Apple was in 2008/2009 as Cupertino was just beginning to monetize its services and golden ecosystem, with the street not seeing the larger golden vision at the time,” he said. “We view this quarter as a major step in the right direction as Tesla plays chess while others play checkers.”

This story was originally featured on Fortune.com

More Fortune:

5 side businesses where you can make over $20,000 a year, while working from home

Looking to earn some extra cash? This CD has an APY of 5.15% right now

To buy a house ? Here’s how much to save

This is how much money you need to make annually to comfortably buy a $600,000 home