Today, investors have access to huge amounts of information that can help them identify the best stocks to buy. So much information, in fact, that it can often lead to overload and confusion, rather than providing a clear signal.

Therefore, it might be best to stick to a simple regimen and let the stock picking experts lead the way. And on Wall Street right now, Jeffries analyst Mark Lipacis is the best of the lot. According to TipRanks, a platform that tracks and measures the performance of anyone giving financial advice online, over the past year, 72% of Lipacis’ recommendations have been successful. At the same time, his picks generated an average return of 29.7%. These measures have positioned the 5-star expert as the best analyst on the street.

Recently, Lipacis penned positive reviews for a pair of semiconductor stocks, believing they are ready to move forward from here. So let’s see how these names set them apart from the pack.

GlobalFoundries (GFS)

The first semiconductor stock we’ll look at is GlobalFoundries, a major player in the US chip industry with a large multinational presence. The company is based in Malta, New York, and operates in the US, EU and East Asia, with a large presence in Singapore. The company’s products are found in smart mobile devices, IoT applications, personal computing, and the automotive, aerospace and defense industries.

Unlike many US-based chipmakers, GlobalFoundries has maintained a strong presence in its home country – with design and R&D centers on the West Coast and manufacturing and foundry facilities in the Northeast. East. That gives the company a built-in advantage at a time of growing geopolitical tensions with China — a major tech competitor — over Taiwan — the world’s biggest chip exporter. Additionally, GlobalFoundries is proactive in protecting its intellectual property and recently filed a lawsuit against technology and business giant IBM, alleging misappropriation of trade secrets.

Home court advantage and safe secrets are good to have, but investors want to see results. GlobalFoundries’ 1Q23 numbers were good, but not all of the news pleased investors.

Quarterly revenue, at $1.84 billion, was down 5% year-over-year but slightly ahead of forecast, beating it by $10 million. Ultimately, GlobalFoundries’ non-GAAP earnings of 52 cents a share rose 10 cents a year and beat estimates by 3 cents. It should also be noted that the company declared liquid reserves totaling $3.23 billion.

However, the stock fell after the earnings release. Investors worried about a loss in adjusted EBITDA ($655 million vs $694.7 million expected by analysts) and the simultaneous announcement of changes in the management team, with the arrival of new people as CFO and CBO.

For his part, top analyst Mark Lipacis isn’t worried. Evaluating the impression, Lipacis noted the company’s “onshore” U.S. footprint as a significant advantage, writing, “We view GFS as the leading trailing node, analog/mixed-signal foundry benefiting from demand for IoT and customers shifting to a fab-lite model. We continue to view GFS as a beneficiary of the supply chain nationalization trend. As a result, we expect GFS to maintain a valuation multiple premium.

Based on this position, Lipacis rates GFS stock as a buy, and he sets a price target of $73 to imply 22% year-over-year upside potential.

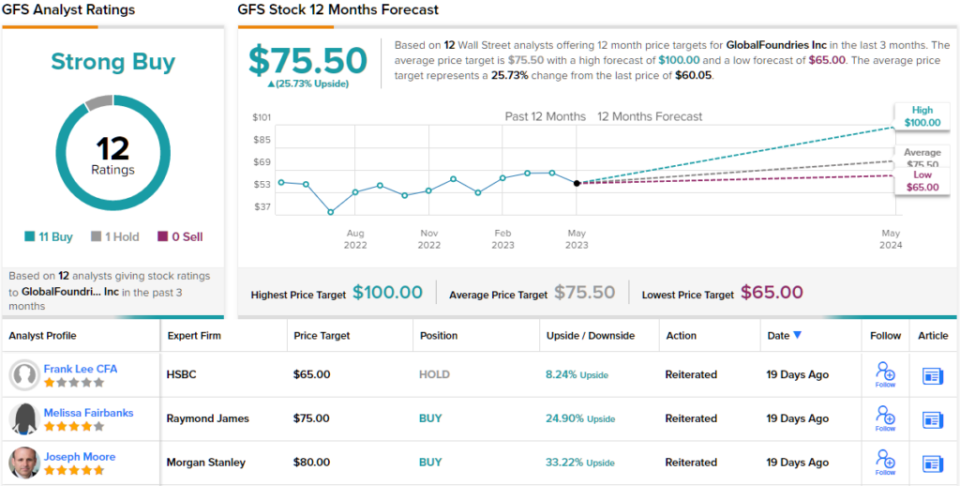

Wall Street’s top analyst is not an outlier here. GFS shares have 12 recent analyst ratings, and these include 11 buy to 1 hold, for a strong buy consensus rating. (See GFS Stock Forecast)

Texas Instruments (TXN)

Next up is Texas Instruments, a Dallas-based company with a long history in technology. The company was founded in 1930 as an electronics manufacturer and by the 1060s had become a strong name in consumer electronics, known for its popular lines of calculators and the ‘Speak & Tell’ educational toy franchise. spell». Today, the company is known as a major supplier of analog technology, electronics and processor chips for the industrial economy, and is a major supplier for automotive and aerospace high-tech needs. TI still keeps a foothold in the education sector and has several graphing calculators on the market.

All this is the context of one of the largest technology companies in the world. TI has a market capitalization of $155 billion and generated just over $20 billion in revenue last year. The company also has a strong track record of returning shareholder value. Since 2004, the company has posted 19 consecutive years of dividend increases, while reducing the number of shares outstanding by 47%. During the same period, TI also posted 11% annual growth in free cash flow.

However, in the most recent quarter, 1Q23, TI posted mixed results. First, revenue of $4.38 billion was down nearly 11% from 1Q22, but was $10 million higher than expected. Net EPS, at $1.85, was down from $2.18 in the prior year period, but beat expectations by 7 cents, or 3.6%.

That said, the company stuck with its guide. The second-quarter revenue outlook was between $4.17 billion and $4.53 billion, versus consensus of $4.46 billion. As for earnings, the second quarter outlook calls for EPS in the range of $1.62 to $1.88; the consensus figure was $1.87.

Looking under TI’s hood after the earnings release, Mark Lipacis remains optimistic. He notes a weaker year-over-year performance, but still feels confident in the long term.

“We highlighted TXN as our top choice large-cap analog ahead of earnings, as it was one of the few analog companies to see hardware cut to CY23 EPS estimates (~20%), and it has been a bottom quartile stock market player since the start of the year… We continue to favor TXN as it trades below the trendline, and we believe its in-house manufacturing strategy will drive market share gains … We remain buyers after printing,” noted Lipacis.

As such, Lipacis reiterated a buy rating and price target of $215 which indicates a 22% margin of appreciation in the stock over the next 12 months.

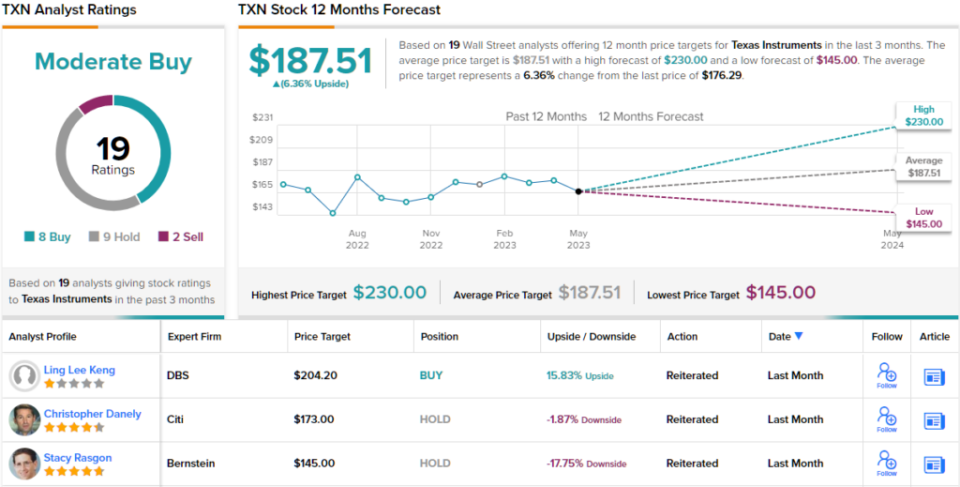

The marquee tech has never failed to catch Wall Street’s attention, and Texas Instruments has 19 analyst ratings on file, including 8 buys, 9 holds, and 2 sells – for a moderate buy consensus rating. (See TXN Stock Forecast)

To stay up to date on Mark Lipacis’ latest ratings and price target, check out his profile page on TipRanks.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The Content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.