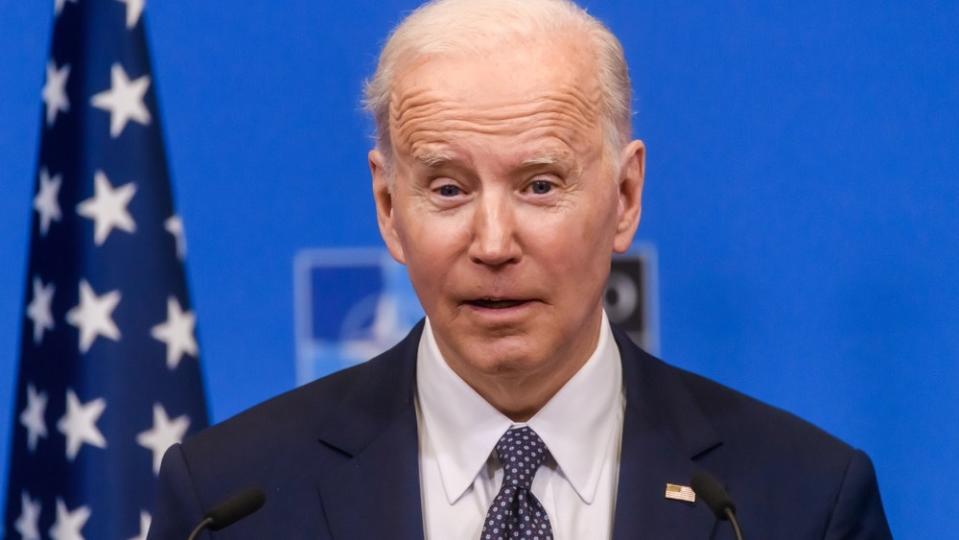

Mortgage fees are changing under new rules from the Biden administration’s Federal Housing Finance Agency. Since some borrowers with good credit may end up paying higher fees than those with lower credit scores, the change sparked discussion.

Among the critics is Peter Schiff, CEO and chief global strategist at Euro Pacific Capital.

During an interview posted on Schiff’s YouTube channel, the host shared plans to buy a home, but expressed fear of being punished if the plan goes ahead due to his good rating. credit.

Schiff’s response was, “Just miss a few payments, screw up your credit score. This will help your mortgage rate.

Schiff, who successfully predicted the 2008 financial crisis, pointed to the problems with this change.

“This new rule encourages people to make lower installments than they might have otherwise made,” he said. “Normally, if you make a big down payment, you get a better rate. But now Biden wants the best rates to go to people who don’t pay a big down payment.

While the new rule could lead to more people becoming homeowners, it doesn’t bode well for U.S. banks, according to Schiff.

“The worst thing about all of this is that it will further undermine the solvency of our banking system because banks are going to be encouraged and in effect forced to make more loans to riskier borrowers, which means more mortgages will end up in default,” Schiff warned.

Admittedly, buying a home can be a burden in today’s environment.

Check:

“These are money pits”

The US Federal Reserve has implemented significant interest rate hikes to rein in runaway inflation. And mortgage rates have also risen, meaning buyers are facing bigger mortgage payments.

According to data from the Mortgage Bankers Association, the median mortgage payment for applicants was $2,093 in March, up 1.6% from $2,061 in February.

In other words, houses are not very affordable in America.

“The Affordability Index reached a new high last month, with the typical amount of purchase request and monthly payment increasing on a monthly and annual basis,” said the Associate Vice President of the Mortgage Bankers Association. , Edward Seiler, in a press release.

When buying a home, you need to consider more than just the mortgage payment. Owners are also responsible for property taxes, insurance, maintenance and repairs.

“The houses are very expensive, believe me, I own several of them,” Schiff remarked. “These are money pits. You can’t own a house when you’re broke.

Investing in real estate without buying a house

Although expensive to buy and maintain, residential real estate remains a popular option for investors. One reason is that the asset is a well-known inflation hedge.

As the price of raw materials and labor increases, building new properties becomes more expensive. And this, in turn, contributes to the appreciation of existing property values.

At the same time, high house prices and high mortgage rates mean that owning a home is less feasible. And when people can’t afford a home, renting becomes the only option. This creates a stable rental income stream for landlords.

If you want to collect passive income by investing in residential real estate, buying a house is not the only option. There are real estate investment trusts (REITs) that specialize in apartment buildings and single-family rentals. And if you don’t want the volatility associated with publicly traded REITs, there are also fractional investing platforms that allow retail investors to invest directly in real estate with as little as $100 in the private market.

Read next:

Don’t miss real-time alerts on your actions – join Benzinga Pro for free! Try the tool that will help you invest smarter, faster and better.

This article ‘Just miss a few payments, screw up your credit score’: Peter Schiff criticizes Biden’s new mortgage rule. Here’s How to Invest in Real Estate Without Buying a House Originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.