The pandemic may have caused a storm, but it has also created fertile ground for innovation.

The rise of AI, led by generative AI tools such as ChatGPT and Stable Diffusion, has not only contributed to the recovery of the technology sector, but has also led it towards unprecedented growth. As we look to the future, one thing is clear: AI is not just part of the tech industry; it becomes THE technology industry.

Markets, in general, are rebounding from the pandemic. However, the advent of AI has been a particular boon for tech stocks, especially hardware makers.

The most obvious recent example, of course, is NVIDIA, the company behind industrial-grade graphics processing hardware and creators of CUDA technology, without which contemporary developments in AI would not be possible.

In just five months, NVIDIA has seen the biggest rise in its share price in its history. It has now recorded a peak of 166% after suffering a 50% drop due to a rough combination of political disputes between the United States and China, the 2022 chip crisis and a market stop. caused by the COVID-19 pandemic. In less than six months, the company has recovered from these losses, and there are no signs of a short-term slowdown.

AI hardware makers are on fire

However, NVIDIA isn’t the only company reaping the benefits of the rise of AI. Other competing and related companies are also benefiting significantly from this new trend. Here are some of the winners.

Advanced Micro Devices Inc. (AMD)

AMD manufactures high performance computing and graphics solutions that are used in AI applications. They have developed specific GPUs and CPUs that are optimized for machine learning and AI workloads, and they are the second most popular GPU choice for home users.

So far this year, the company’s shares are up 94% from $65 to their current price of $125. If the stock price reached $145, that would offset all the losses from last year.

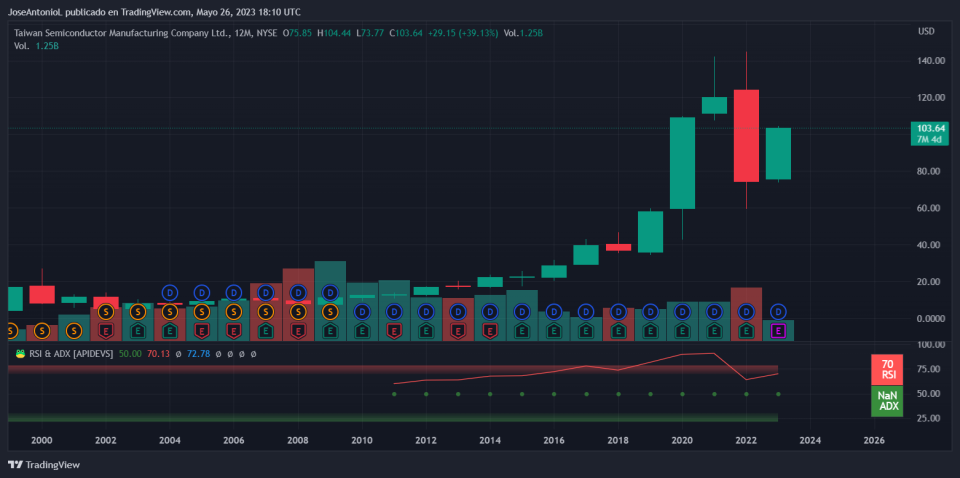

Taiwan Semiconductor Manufacturing (TSM)

TSM is the largest independent dedicated (pure-play) semiconductor foundry in the world. As a foundry, they produce chips for various companies, many of which are involved in AI.

The business is up 39% since the start of the year. With a further 20% rise, it would recover the losses of 2022. Chip crisis? Or?

Micron Technology (MU)

Micron Technology is a world leader in the semiconductor industry. They manufacture a wide range of memory and storage products, which are crucial components for artificial intelligence and machine learning systems that require fast and efficient data processing.

Shares of MU are up 47% so far in 2023, and they have the potential to grow another 27% before encountering resistance marked by their own all-time high.

Three AI-related software stocks to watch

Beyond the realm of hardware, software vendors are also having a spectacular year, especially due to the explosion of generative AI, with ChatGPT leading the hype.

Meta (META)

Formerly known as Facebook, Meta is an investor favorite. Shifting focus from the metaverse to AI is paying off for Mark Zuckerberg’s company, which in addition to implementing solutions in its traditional business model has also released significant open source contributions, including the Large Language Model LLaMa.

A large language model (or LLM) is an AI model trained on a large amount of textual data and capable of generating human-like responses to different text prompts. (It simulates a natural language conversation.) LLaMA is a very popular LLM among AI users and developers.

Meta posted its best half-year performance in history, rising 116% so far in 2023.

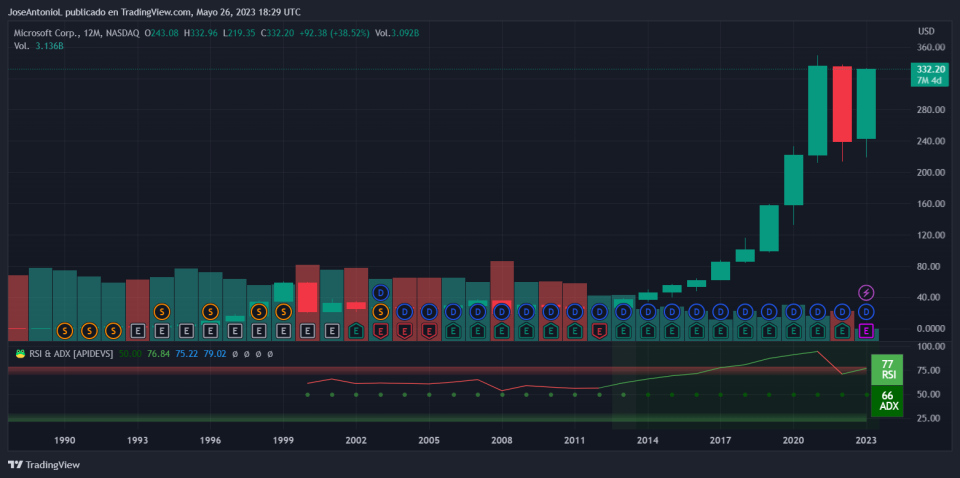

Microsoft (MSFT)

Bill Gates’ company is famous for being the creators of Windows and the Xbox game console. But now he’s gaining traction to be the “godfather” of OpenAI, the company that developed LLM GPT-4 and ChatGPT, the chatbot that put AI in the media spotlight.

OpenAI is valued at $29 billion and Microsoft alone has invested $13 billion. The decision to integrate GPT-4 into their Edge browser and Bing search engine, as well as to use Bing as the default search engine for ChatGPT, was a catalyst for the tech giant’s share price. . So far in 2023, Microsoft has grown nearly 40%, offsetting losses from the previous year,

Alphabet Inc (GOOGL)

Alphabet, the parent company of Google, is heavily invested in AI. They have developed Tensor Processing Units (TPUs), which are custom-developed application-specific integrated circuits (ASICs) used to accelerate machine learning workloads. They are also the developers of TensorFlow, an open source AI library, and offer cloud-based AI services. In the area of software, the company has been much more active.

Bard’s launch with its improved PaLM2 was a success, positioning it as a direct competitor to ChatGPT. The release of customer-tailored LLM models generated a positive response among its investors (unlike what happened when the company introduced its first chatbot and it started hallucinating). GOOGL shares are up 40% so far this year and are 20% off growth until they challenge resistance at their all-time high again.